The Weekly Equity Write-Up: We've Entered The SuperBowl of Q1 Earnings But Do They Really Matter?

“Earnings don’t move the overall market; it’s the Federal Reserve Board… focus on the central banks and focus on the movement of liquidity… most people in the market are looking for earnings and conventional measures. It’s liquidity that moves markets.”

- Stanley Druckenmiller

Over the past 5 days, I received the most calls from clients and partners both on the sell-side & buy-side in all of 2024. First, it started Saturday & Sunday with questions like “This feels like the start of July -October 2023, Do you think this selloff has legs?”. Then Yesterday’s bombardment of calls consisted of “Is the sell-off over and do we add back growth tech exposure?”………….My Simple answer is:

1.) We’ve pivoted to an Economic Print to an Economic Print environment where softer or stronger data on inflationary drivers will move markets drastically over the foreseeable months.

Today we have a lot to cover so let’s jump right into it!

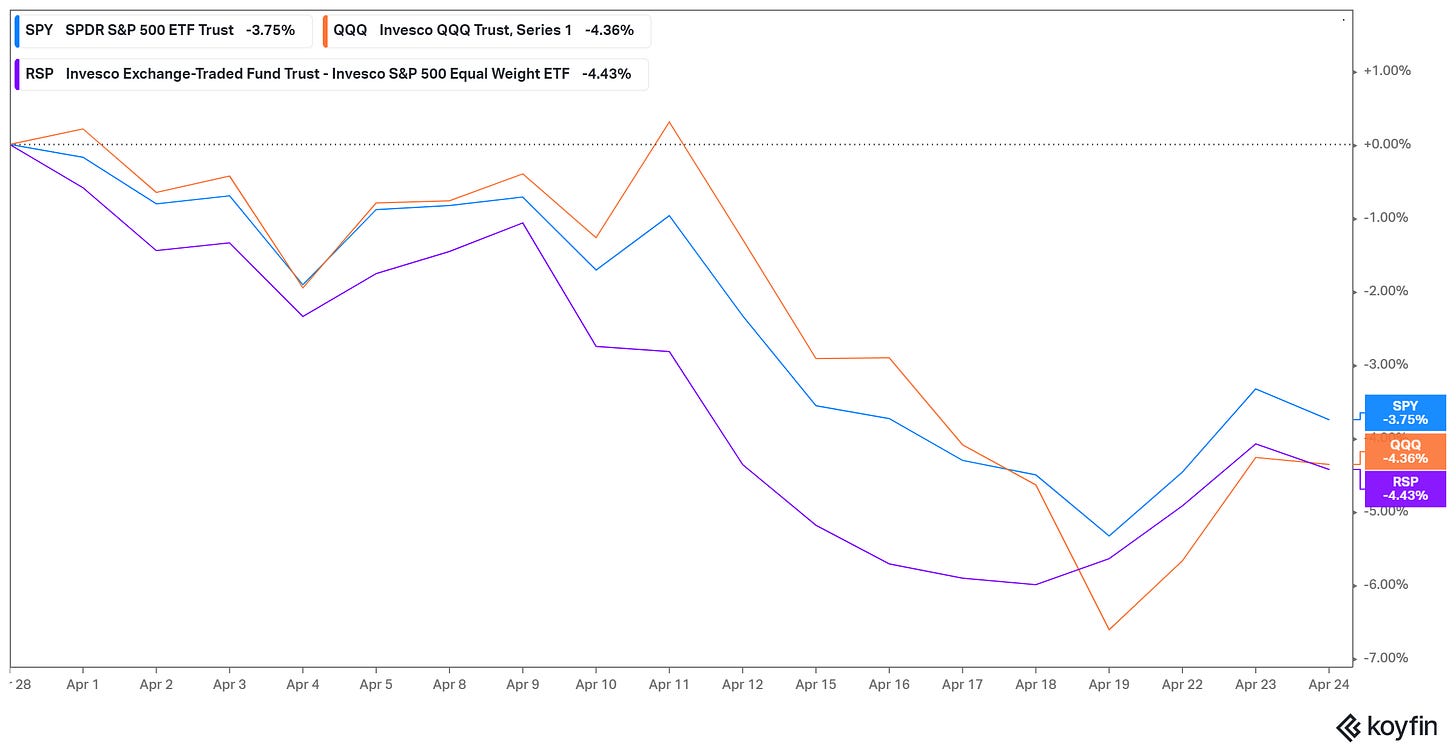

Over the weekend I covered —> Active managers are now net long +74k ES1 contracts. This is what the market needed for its correction. The past two major drawdowns in $SPY took place at the start of 2022 when Active positioning was extremely bullish into the start of the rate hiking regime. The second and most recent was last year July-October 2023 when Actives started covering their Macro Hedges. Now as inflationary pressures remain sticky and CTA's and Vol Funds are unloading as their sell targets are getting hit.... the rest of the active space will have to put back on their hedges at a hefty price due to poor top-of-book liquidity

This week we had a soft Service and Manufacturing PMI’s which many have come to believe was the cause of Tuesday’s broad rally. I believe the rally was a technical bounce in a low liquidity environment. I would not get too excited instead focus on positioning into each macro event and its impact on the yield curve!

Let’s look at 10 things I’m monitoring..

Keep reading with a 7-day free trial

Subscribe to SpearPoint Equity Alpha to keep reading this post and get 7 days of free access to the full post archives.