The Weekly Equity Write Up: Postponing the Goldilocks Landing

Post FAAMG Earnings and CPI Positioning

“The first thing I heard when I got in the business - not from my mentor - was, 'Bulls make money, bears make money, and pigs get slaughtered.' I'm here to tell you I was a pig. And I strongly believe the only way to make long-term returns in our business that are superior is by being a pig.”

-Stanley Druckenmiller

Macro Regime Update:

The goldilocks landing and March rate cuts have been pushed to May, a view we published previously due to the hot December CPI print (link). The FOMC meeting came with little surprises to us as Powell took a neutral to slightly hawkish tune by taking March cuts off the table and he reiterated it last night in his appearance in “60 minutes”. Powell is cornered in a reputational dilemma “be the next Arthur Burns or Paul Volcker”. His cautionary approach (many called hawkish) is completely justified as headline inflationary pressures have seemed to re-emerge.

The economic data has been coming in healthy with strong GDP growth (3.3%), blowout NFP (353k vs est 180k), increase in hourly wages which some find questionable (4.5% vs est 4.1%), and strong construction data (.9% vs est .5%). Gasoline Prices are climbing back to December highs and container freight prices have risen over 65% which we’re closely monitoring. This week we have a plethora of Fed speakers during a low single-name equity volume environment that will cause some unique price action…..BUCKLE UP!

Gasoline Prices:

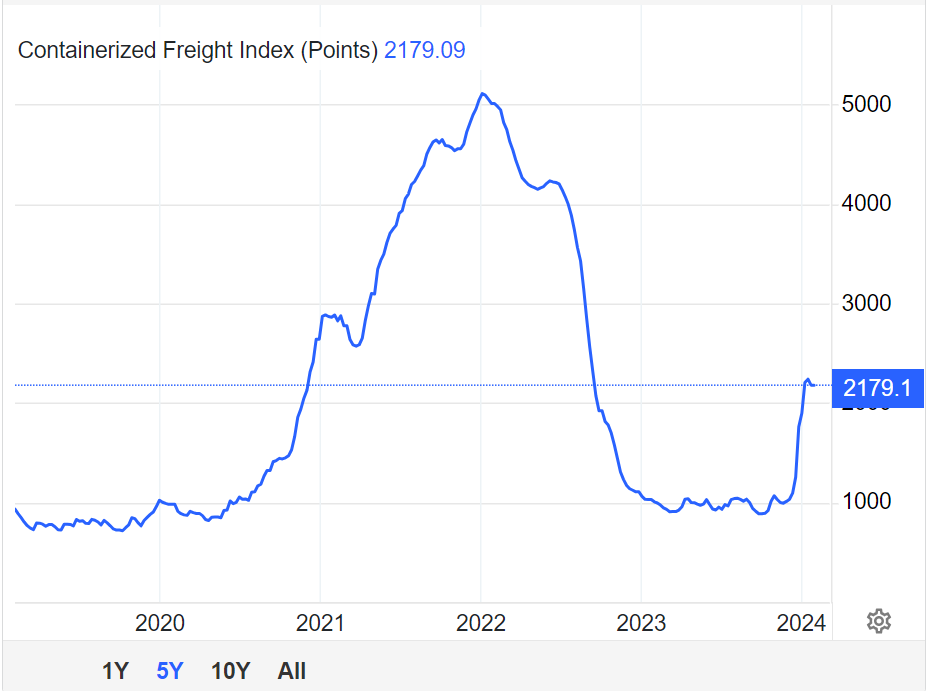

Container Freight Index:

The geopolitical turmoil in the Red Sea is now entering its 4th week with American Forces ramping up military operations in the region. The Red Sea accounts for 13-15% of the world’s shipping traffic. The unrest in the region has forced ships to reroute from using the Suez Canal to the much longer route around South Africa’s Cape of Good Hope which has increased shipping by 6 to 10 days. Unfortunately, the country most impacted by the turmoil in the region has been Egypt as it’s surrounded by war on all fronts and the the drop in shipping activity through the Suez Canal has devastated its economy. We’re closely monitoring the region for any sign of possible slippage into CPI line items.

Positioning:

Since the GME/MEME/High Short Interest stock squeeze of 2021 Institutional investors have drastically deviated from shorting single stock to using macro products like ES1 futures, ETFs, and thematic baskets created at brokerage houses to to mitigate risk. Since last week’s FOMC meeting institutional investors have moved to a defensive posture by increasing their gross exposure by adding to their short books with the products mentioned above. ES1 active positioning last week was net short -226k contracts (7k contracts above my estimates from the week prior). As we get to next week’s CPI print we’ll be at net short -295k contracts as Actives become more defensive/market neutral. Not to mention equity CTA’s are net long stock and will become sellers on sharp downturns. With that being said across most prime brokers positioning into Mag7 is sitting above the 85 percentile signifying a flight to 2023’s safe havens.

ES1 Positioning

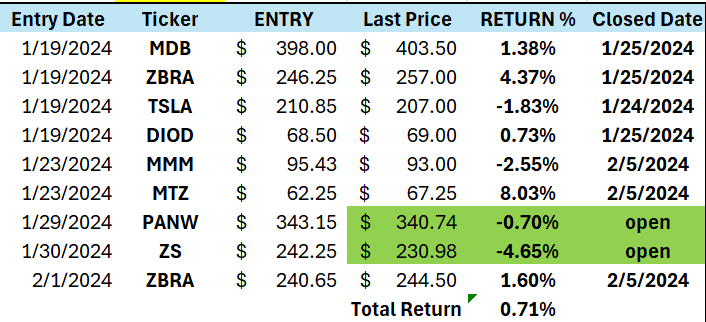

Trade Update:

Today We’ve taken profits on ZBRA (+1.60%) & MTZ(+8.03%) and took a loss on MMM as our Stop loss was hit.

We currently have an open a ZS(SL of 225) long position and we’re letting the market digest the recent departure of its COO Dali Rajic

Long PANW (SL 335) with a price target of $355

New Mean Reversion Trade:

We’re opening up a long $TEAM trade with a $216.75 entry (210 stop loss) and a price target of $229. I believe the price action post earnings is pod profit-taking. The Company had a solid beat and raise.

Highlights below:

Earnings Per Share (EPS): Reported EPS of $0.73, beating consensus estimates of $0.62 by 14.06%. Revenue Growth: Achieved $1.06 billion in revenue, surpassing expectations of $1.02 billion, a 21.47% increase year-over-year.

Q3 Revenue Forecast: Expects Q3 revenue between $1.085 billion and $1.105 billion, above the consensus of $1.06 billion.

Subscription Revenue: Subscription revenue reached $932 million, up 31% year-over-year. Operating Margins: GAAP operating margin at (5%), with non-GAAP operating margin at 24%. Cash Flow: Generated $290 million in cash flow from operations and $284 million in free cash flow.

Conclusion

Recent economic data has been coming in hotter than expected dampening the hopes of the highly anticipated March FFR cut. We believe that Institutional investors will continue to increase their defense posture into next week’s CPI.

Keep an eye out for additional trades we publish into or post-CPI.

If you are interested in private consulting or bespoke research, email us at Capitalflowsresearch@gmail.com

What pricing will look like: The quality of insights and trades in this publication will speak for themselves because they will show you how to run high R:R trades from an institutional perspective. However, we are making the entire publication 100% free for the first 30 days so that people can get their bearings and be on the same page. When we launch the paid tier, if you have already pledged at $45 a month, you will be locked into this price and there will never be any price increases for you.