The Weekly Equity Write-Up: Pockets of Software Are Looking Attractive

Filter Out The Noise

“Stock market goes up or down, and you can’t adjust your portfolio based on the whims of the market, so you have to have a strategy in a position and stay true to that strategy and not pay attention to noise that could surround any particular investment”

- John Paulson

Big Picture:

Q2 has started off on a bumpy road for risk assets, especially for those on the far end of the risk curve. During times of Market Volatility, the key is to trade less and reevaluate your investment thesis. Today we’ll do a deeper dive into our process

1.) Macro Pulse

2.) Institutional Positioning

3.) Sector Pulse

4.) Software Names to Monitor

But first, let’s start with a little hedge fund story….As a trader at a hedge fund, you serve as the eyes and ears for your PM (sometimes the punching bag on down days). On days like today when market volatility spikes and your stocks selloff you better believe you’ll be asked to call and get MARKET COLOR from every sell-side desk your firm is sending a check to!

Once you find yourself on these calls with your sell-side trader counterparts you quickly realize 1.) 90% are just that salespeople. 0 skin in the game 2.) Can’t say much because they have to protect their other clients despite your PM thinking he’s George Soros 3.) Most likely fighting an excruciating hangover from the previous night's client outing! Now, 90 minutes have passed and you absolutely learned nothing new except two guys you really trust, gave you a different narrative that could make you seem like the MESSIAH to your PM on a 2% down day. After you relay the market color you either get a sell order just to buy it all back at 9:30am the next day once your PM realizes his thesis is still intact and it was just a technical market pullback!

Unlike Hedge Funds which are paid to deploy capital, many of you reading this are not tied to such strict mandates so if you feel uncomfortable stay in cash.

To conclude, this is the power of knowing the difference between a technical pullback and a fundamental move...... if anyone knows why $TEAM and $DDOG were up today while all of growth tech/software was down ...please SEND OVER SOME MARKET COLOR!

1.) Macro Pulse

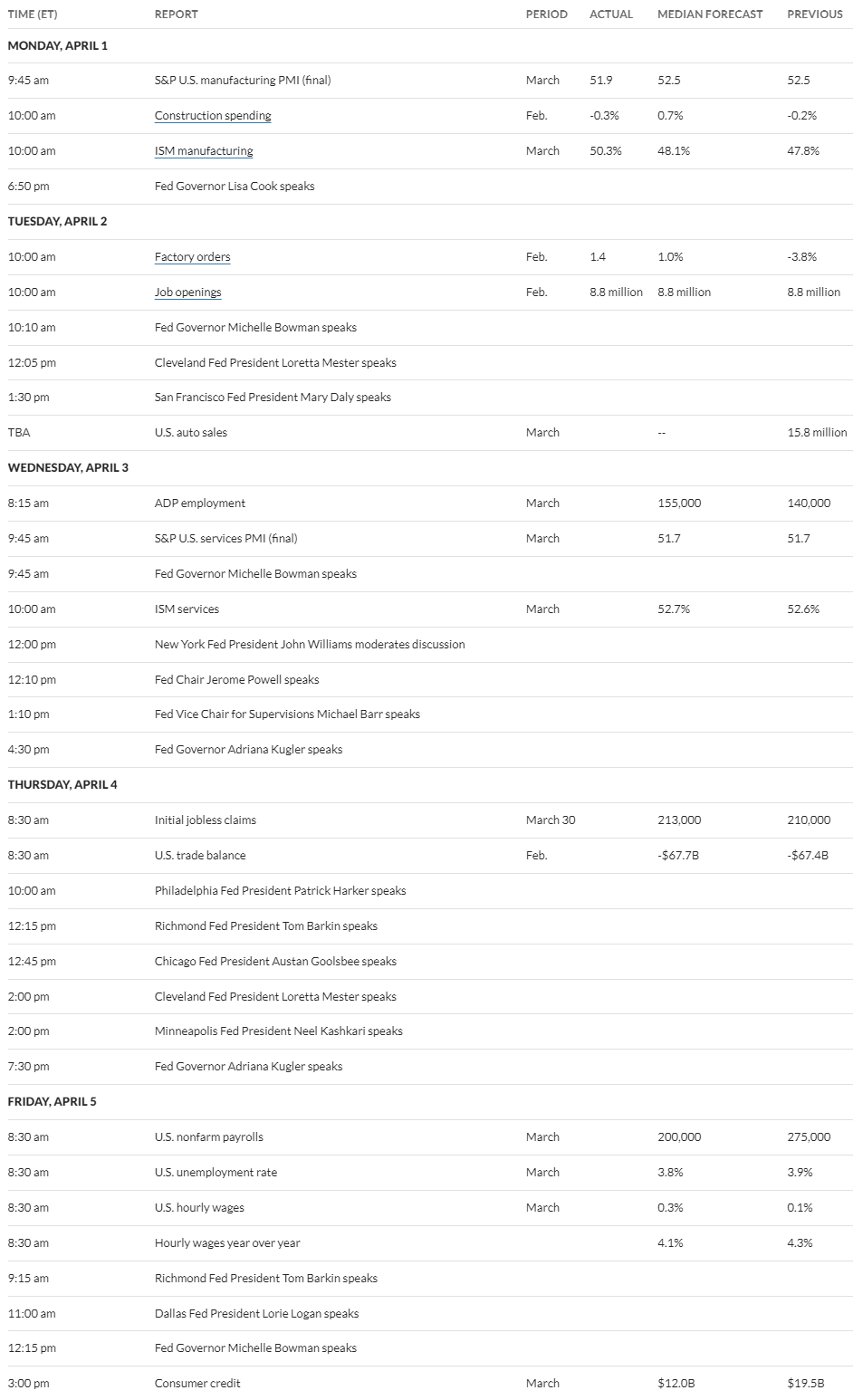

This week we have 14 fed speakers scheduled, the highlight being Powell speaking today. Following the plethora of speakers, on Friday we’ll get the highly anticipated jobs report where I predict full-time employment will continue to come in weaker as part-time employment grows.

This week I want to zoom out and emphasize that inflation has come a long way from the 2022 highs. The previous easy money era of 2009-2021 consisting of a 0 to .50% fed funds rate is behind us and we will not return to that environment unless something breaks within our financial system.

Keep reading with a 7-day free trial

Subscribe to SpearPoint Equity Alpha to keep reading this post and get 7 days of free access to the full post archives.