“I just wait until there is money lying in the corner, and all I have to do is go over there and pick it up. I do nothing in the meantime.”

-Jim Rogers

Big Picture:

All eyes and ears are on the FOMC this week. Today we’re going to cover the following Topics

Macro Pulse

Institutional Positioning Pulse

Sector Pulse

Trade Updates and Trade Ideas

1.) Macro Pulse

Wednesday brings the FOMC and a dot plot (To this day, I find this piece useless but you’ll be surprised by how intensely some active managers look at this). The market is currently pricing in three cuts this year. Due to the recent sticky CPI print last week, while the Fed was in their PRE-FOMC blackout period, we will continue to see de-risking in the equity market into the FOMC meeting. While Powell’s press conferences often contain an element of surprise, I believe he’s going to stick to his baseline from the “Semiannual Monetary Policy Report to the Congress” and the markets chug along.

"We believe that our policy rate is likely at its peak for this tightening cycle. If the economy evolves broadly as expected, it will likely be appropriate to begin dialing back policy restraint at some point this year. But the economic outlook is uncertain, and ongoing progress toward our 2 percent inflation objective is not assured. Reducing policy restraint too soon or too much could result in a reversal of progress we have seen in inflation and ultimately require even tighter policy to get inflation back to 2 percent. At the same time, reducing policy restraint too late or too little could unduly weaken economic activity and employment. In considering any adjustments to the target range for the policy rate, we will carefully assess the incoming data, the evolving outlook, and the balance of risks. The Committee does not expect that it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent.”

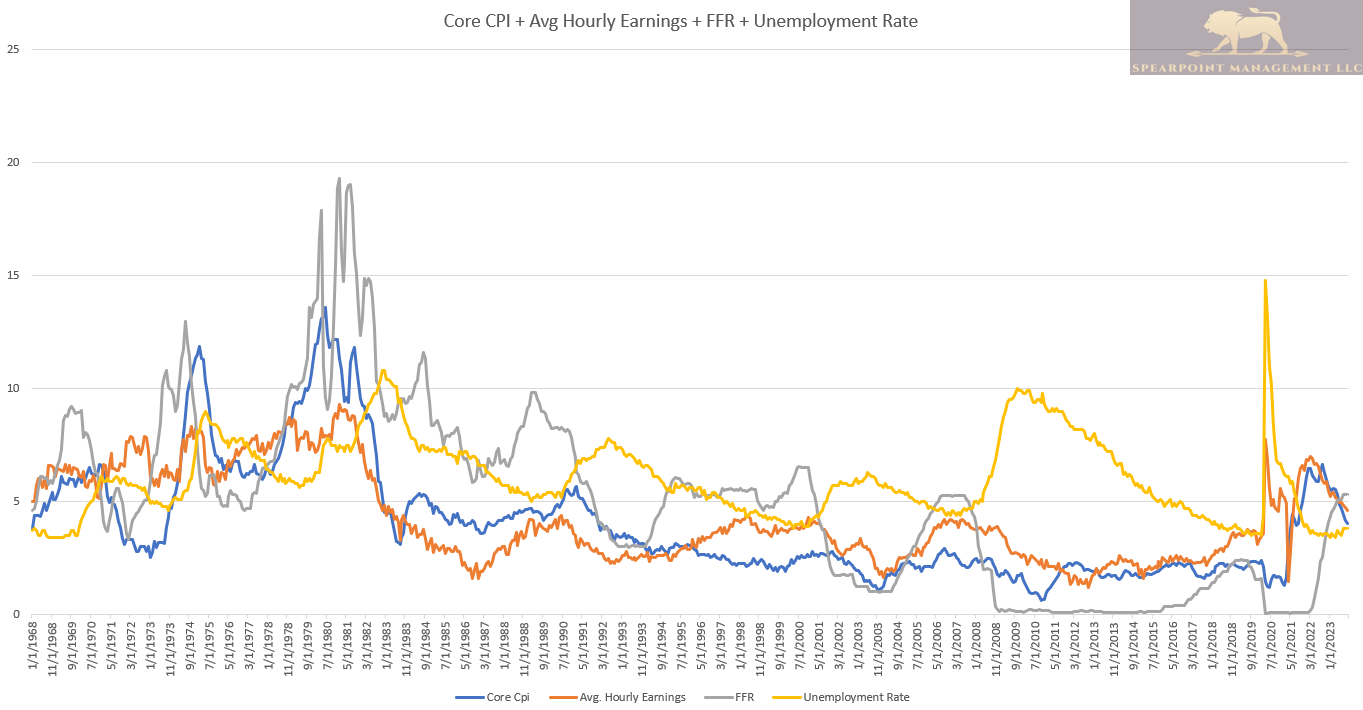

As I’ve mentioned previously, I’m predicting, the Fed will start cutting rates in July because 1.) A moderate increase of unemployment above 4.1% (Despite being historically low) over the next two months could be enough for them to see the easing of labor market tightness 2.) There’s a two-month gap before the September meeting and it will allow the Fed to see how the economy will react to the first 25bps cut 3.) If they wait until September or closer to the Election it will look like a political stunt in favor of the Democrats.

Core CPI + Avg Hourly Earnings + FFR + Unemployment

Things I’m closely monitoring on the inflation front:

1.) Container Freight Index after a +65% jump at the beginning of the year is slowly coming down since the end of February (down -18%)

2.) Baltic Dry Index is up 48% MoM!

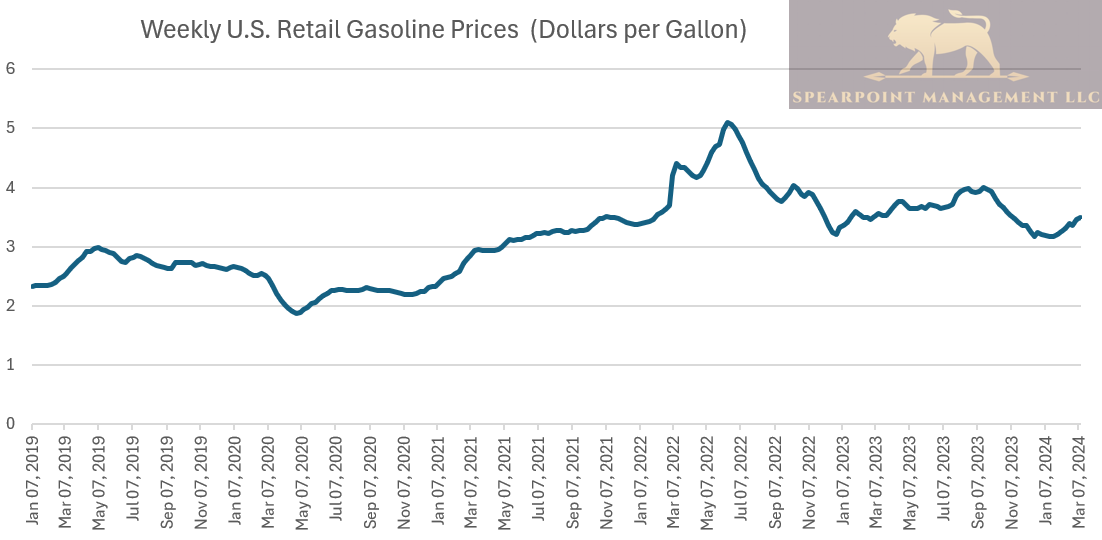

3.) Gasoline prices continue have been rising since January and are up 3.77% since February

2.) Institutional Positioning Pulse

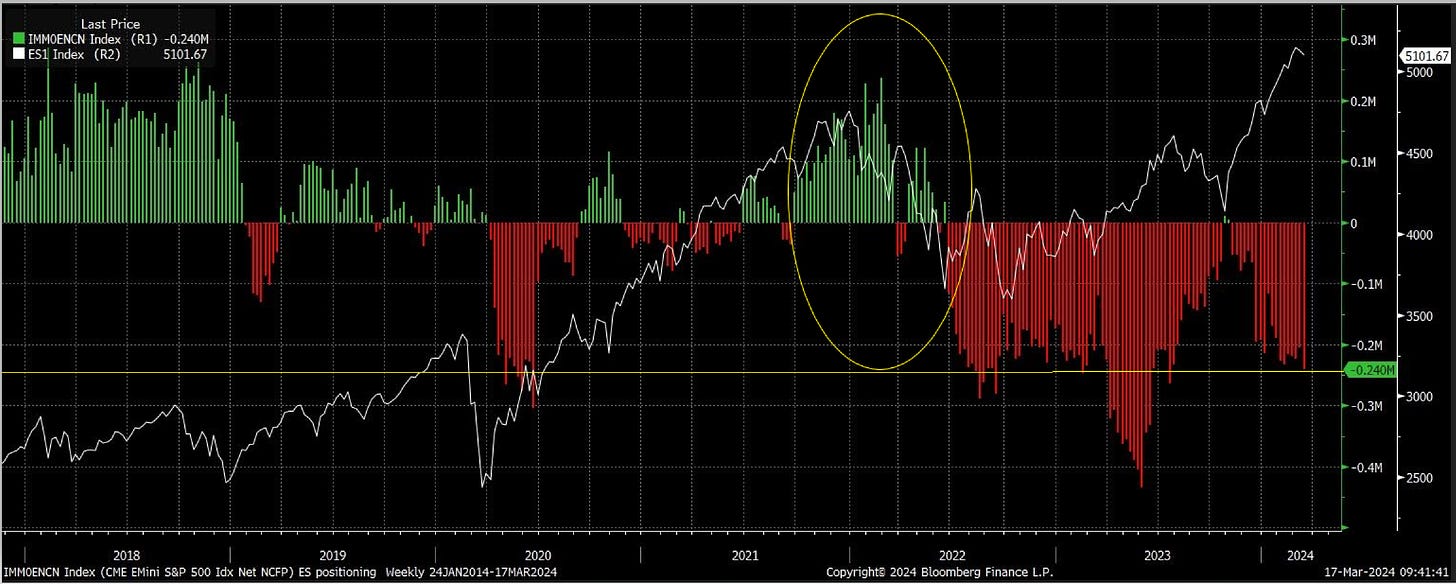

Active managers are well hedged into Wednesday’s FOMC as they’re net short -240k contracts. As I mentioned 2 weeks ago in the article below, the market structure, the make of the S&P, and the current positioning make it tough to get a doomsday selloff (Sorry PERMABEARS)

Keep reading with a 7-day free trial

Subscribe to SpearPoint Equity Alpha to keep reading this post and get 7 days of free access to the full post archives.