The Weekly Equity Write-Up: Economic Softness Is Brewing

Some Pockets are looking Attractive

"I'm constantly fighting my bearishness about the world. One of the great hedge fund managers of all time, Bob Wilson, the greatest short seller ever, said he made 90% of his money on the long side, the math just works against you. If you're perfect on a short, you can double your money. But if you're wrong on a short, you can lose 10 times your money. If you're dead wrong on a long, you lose your money. But if you're right, you can make 10 times your money. It's a mathematical inverse of that with shorting. You don't have to be a rocket scientist. I know, therefore, that if you have a bearish bias, you have to be very aware of it. You have to work around it. And I always have."

-Stanley Druckenmiller

Big Picture

Morgan Stanley’s permabear, Mike Wilson capitulated two weeks ago as markets hit all-time-highs but bears, I wouldn’t celebrate too soon because J.P Morgan’s Kolanovic is still bearish!

Today we’re going to cover:

1.) Macro Pulse

2.) Institutional positioning and Sector Pulse in Equities

Before we start, I highly recommend you turn the Chat notifications on for the substack and follow me on X at https://x.com/OpulentVocation. I’ll be posting a freebee like the one below every month or so

1.) Macro Pulse

There’s no question that markets have become gamified with the influx of leveraged products and brokerage applications like Robinhood and Webull which in turn has intensified the hyperactivity you see in the retail trading community around macro events that have minimal impact in the long run. Successful market operators step back, block out the noise, and zoom out!

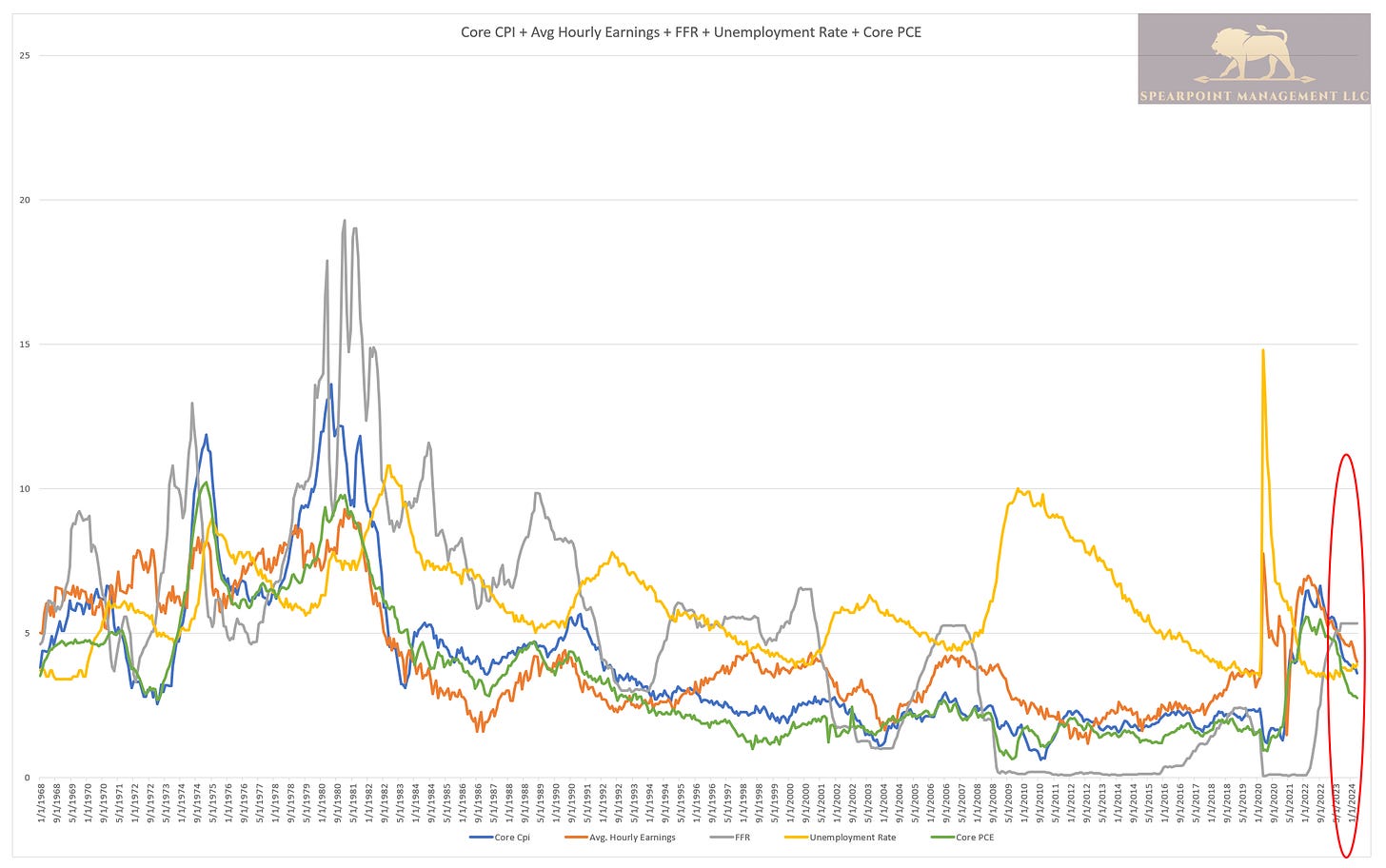

Inflationary Pressures are coming down but at a pace slightly slower than the hyperactivity crowd would like. Core CPI, Core PCE, and most importantly Hourly wages are moving in the right direction.

Signs of an economic slowdown are appearing globally. It started last week with China’s Manufacturing PMI falling back into contraction. China's May manufacturing PMI fell to 49.5, down from 50.4 in April. May's manufacturing PMI marked a 3-month low and was disappointing after the recent strength of industrial activity data. The PMI was notably weaker than the market forecast, which expected an uptick. The main reason for May’s decline was a drop in new orders (49.6) and new export orders (48.3), which fell back into contraction after two months of expansion.

Then to start this week, the US ISM Manufacturing Index, A key barometer of U.S. factories fell to a three-month low as new orders waned showing businesses are reluctant to invest due to the high interest rate environment. New orders reflect anticipated demand in the months to come, and declines throughout 2024 thus far suggest that manufacturers have a weaker second half of this year ahead of them.

The energy market is rapidly bracing for the slowdown despite this weekend’s OPEC+ production cut extension to the end of 2024! I personally believe WTI Crude will fall under $72 in the next two weeks. My thesis is as follows:

Weaker global demand through contractionary manufacturing signals globally accompanied with the approval given to Ukraine to use long-range missiles (NATO made weaponry) to attack Russia on Russian Soil, whichI'm confident the Ukrainians will attack strategic targets (REFINERIES) to slow down the Russian war machine, will force Russia to ship out as much URALS OIL to foreign refineries......THIS IS BEARISH CRUDE!

At these levels(Below $74) The U.S Department of Energy needs to announce the solicitation of refilling the SPR at $72 (From $79 WTI) or better. This will stabilize WTI crude at $72 for the foreseeable future.

Keep reading with a 7-day free trial

Subscribe to SpearPoint Equity Alpha to keep reading this post and get 7 days of free access to the full post archives.