Neither a state nor a bank ever have had unrestricted power of issuing paper money without abusing that power.

- David Ricardo

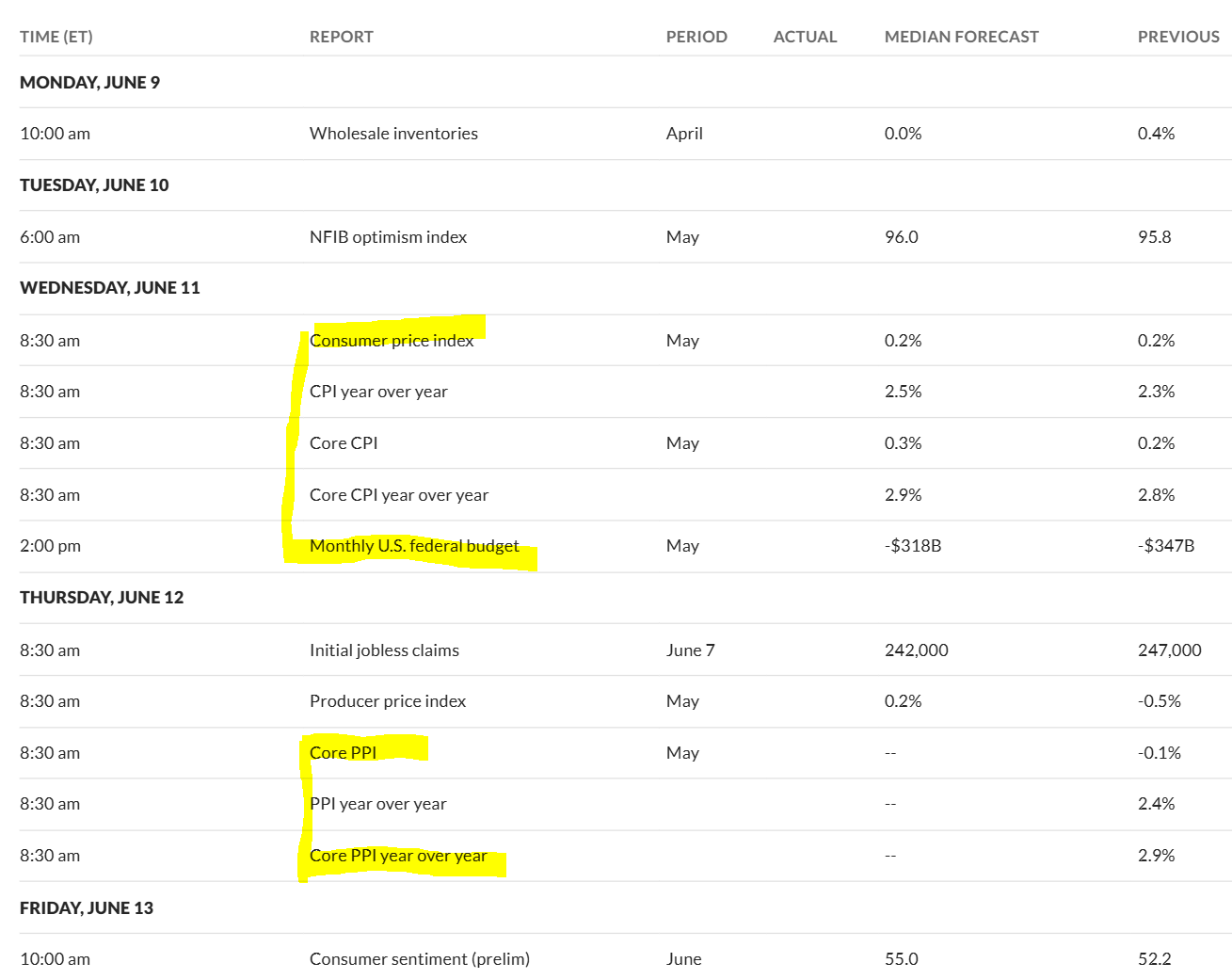

On the economic front next week, Monday and Tuesday will be quiet, but all eyes will be on Wednesday’s CPI print, followed by Thursday’s PPI print.

As I mentioned last week, I believe we will break our first ES price target of 6050 this upcoming week.

How will we get there?

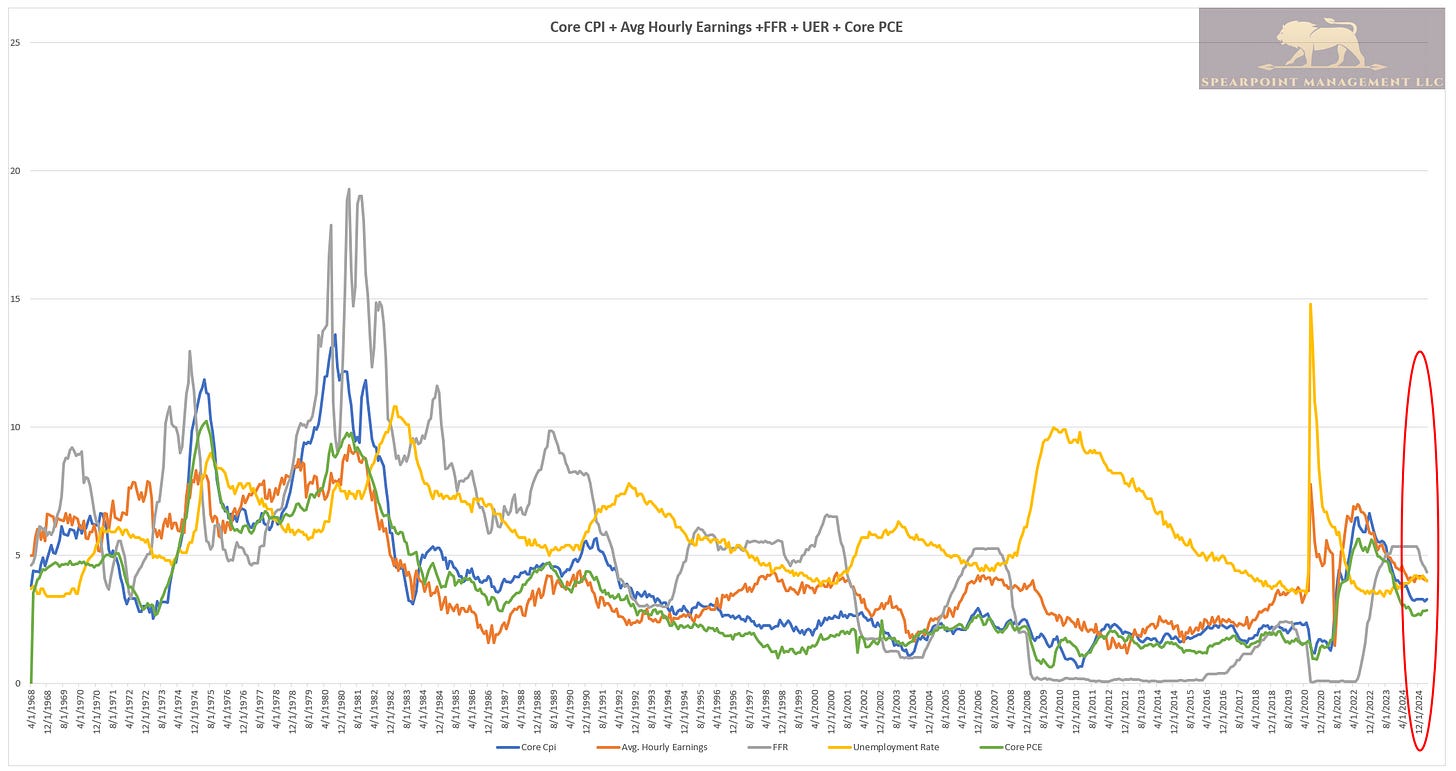

It will be crucial for Core CPI to come in at or below the census. The US labor market is still strong, as I mentioned in the article below

Trade Update 5/30/2025

A recession is when your neighbor is out of work. A depression is when you are out of work.

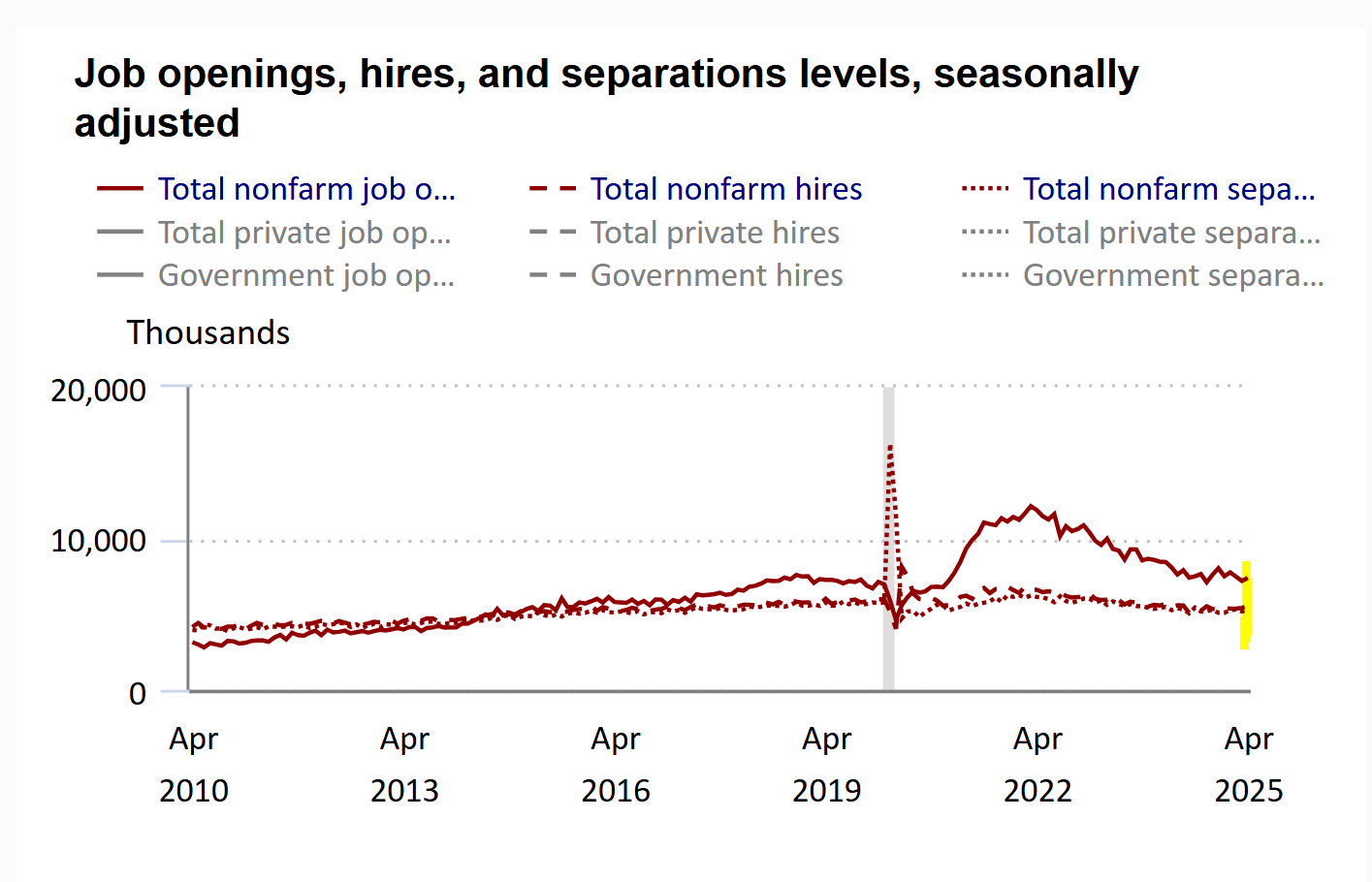

Last week’s NFP and JOLTS numbers confirmed that! JOLTS increased in April

But most importantly, hourly wages are still above the inflation rate, and Unemployment remained unchanged. I’ll repeat that an Unemployment rate under 5% is a sign of a strong consumer base.

Further, the Low positioning in the Hedge Fund Long/Short community will continue to fuel the rally as they add back to their net exposure.

Keep your Chat notifications turned on because this week the team will be adding risk across the risk curve!