Teach a parrot to say demand and supply, and you have created an economist.

- Anonymous

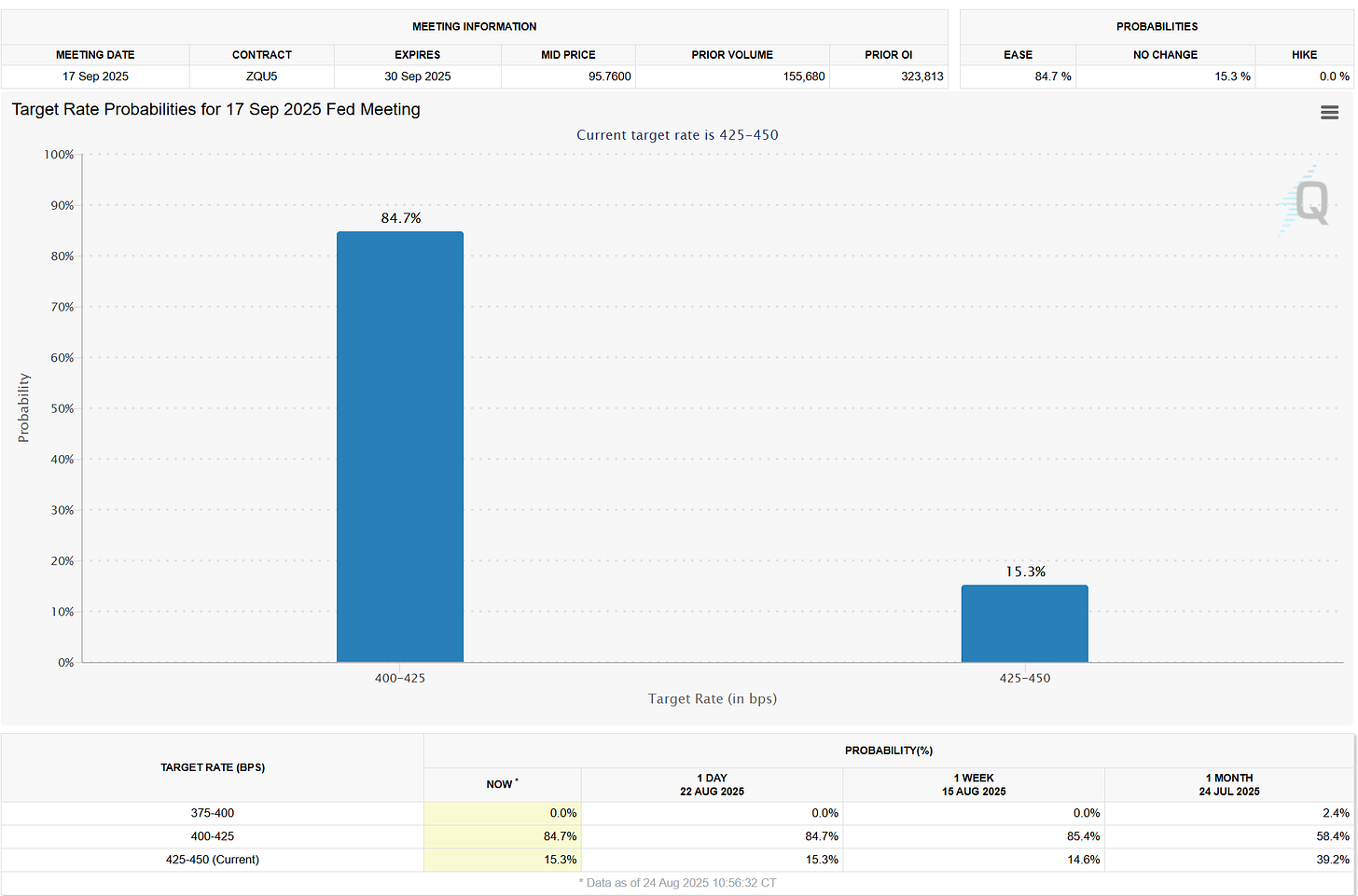

After Powell’s Jackson Hole speech, Markets are back to pricing an 85% chance of a 25bps rate cut at the September 17 Fed meeting.

Below is the most critical part of Powell’s speech………………………………………………….

“Come what may, we will not allow a one-time increase in the price level to become an ongoing inflation problem. So putting the pieces together, what are the implications for monetary policy? In the near term, risks to inflation are tilted to the upside and risks to employment to the downside. A challenging situation when our goals are intended like this, our framework calls for us to balance both sides of our dual mandate. Our policy rate is now 100 basis points closer to neutral than it was a year ago. and the stability of the unemployment rate and other labor market measures allows us to proceed carefully as we consider changes to our policy stance. Nonetheless, with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy stance. Monetary policy is not on a preset course. FOMC members will make these decisions based solely on their assessment of the data and its implications for the economic outlook and the balance of risks.”

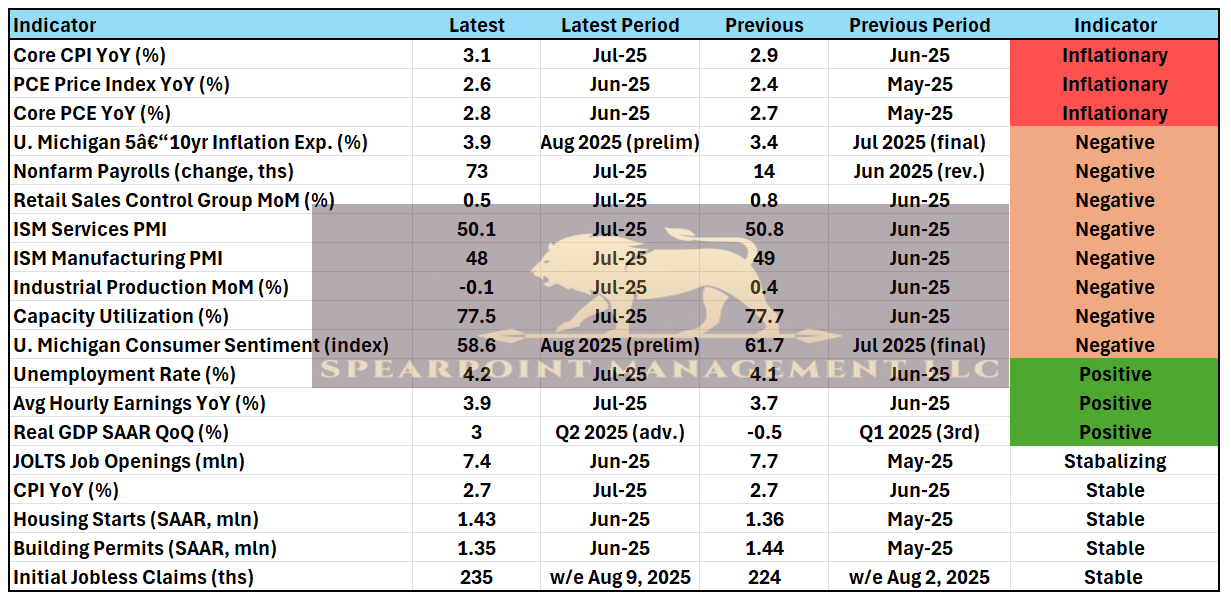

The main takeaway ……… Core CPI is not their primary focus, and the Fed will now take a more proactive approach to fulfill their dual mandate.

The economic indicators we’re monitoring are all pointing to a weaker underlying economy that is being overshadowed by growth that AI CapEX is solely driving.

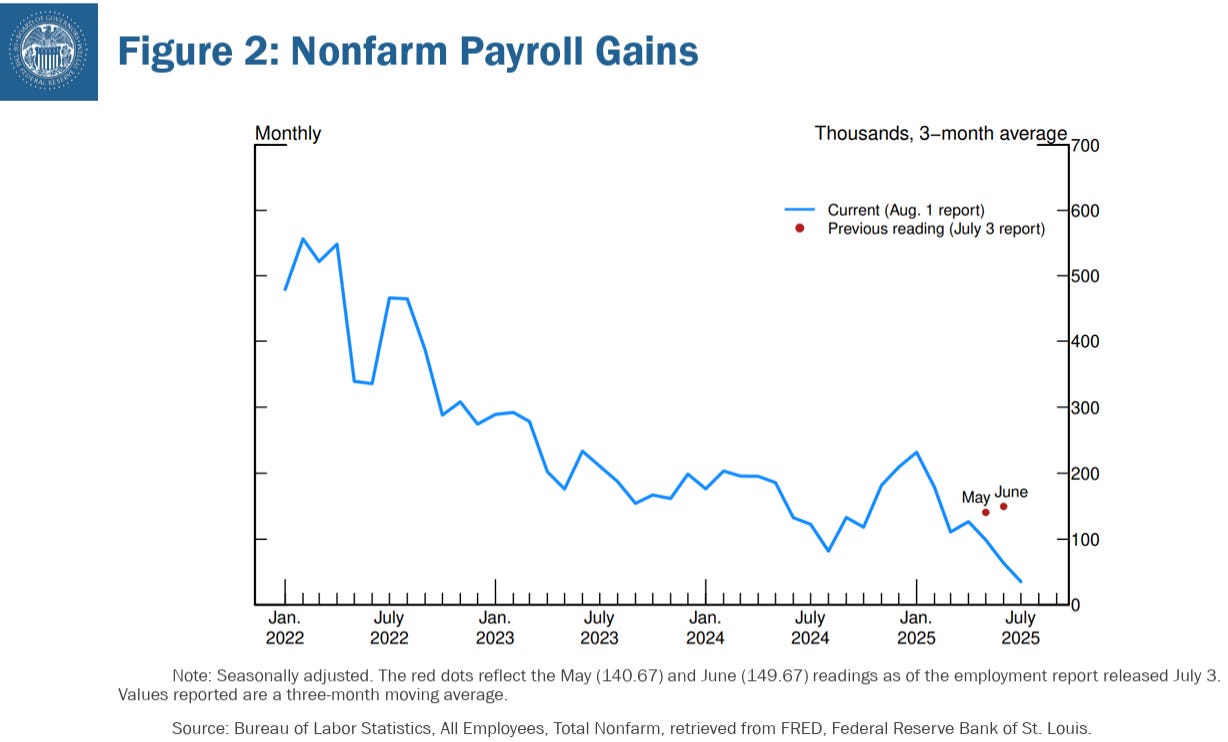

Despite the pickup in Core CPI and PCE, Powell and the Fed are trying to pivot their game plan to a more proactive approach to balance both sides of their dual mandate, to achieve maximum employment and price stability. The current unemployment rate remains at historic lows (at 4.2%), and Average Hourly Earnings YoY remain strong (+3.9%), but what bothers the Fed is the sharp decline in Nonfarm Payrolls displayed below.

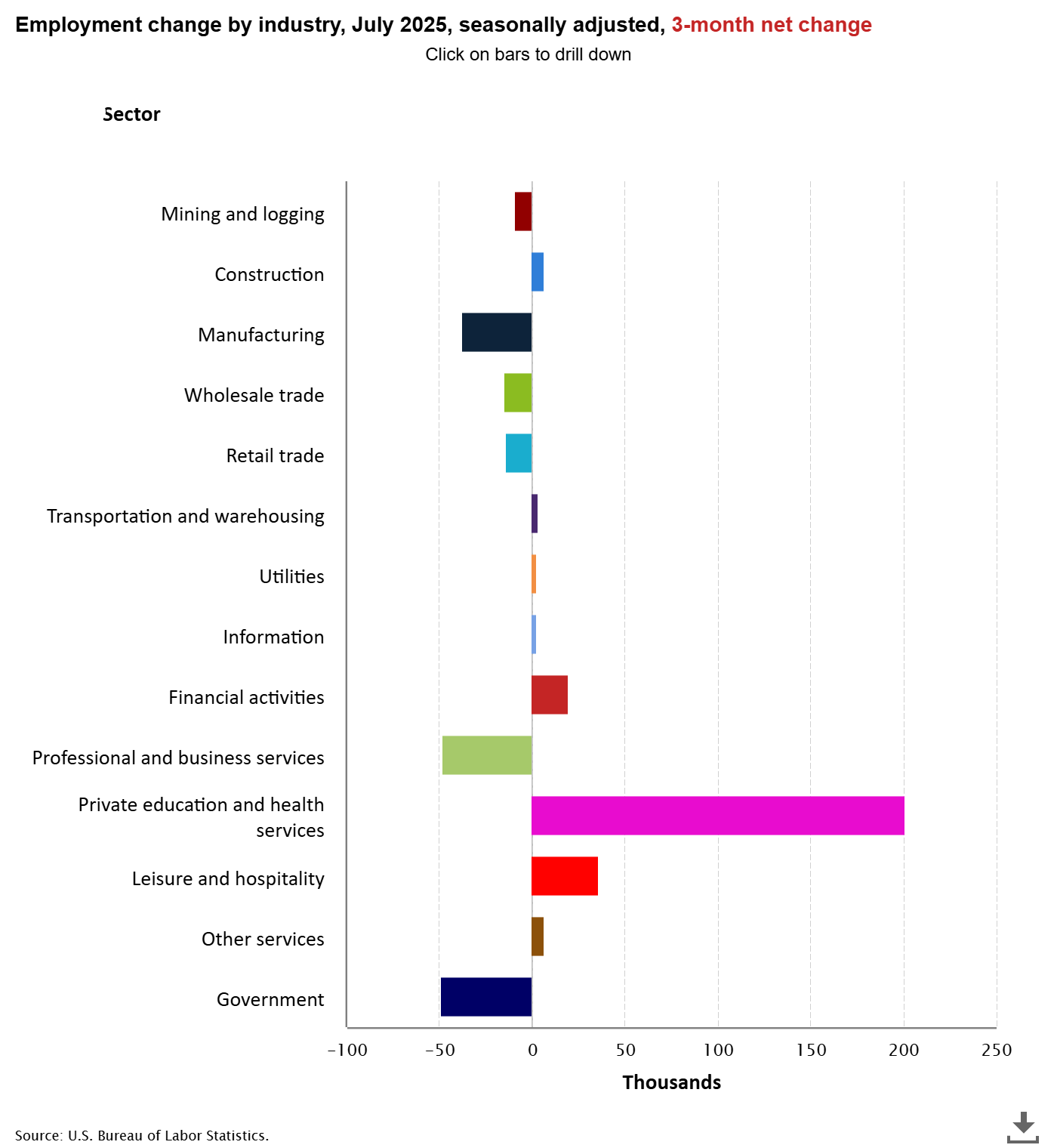

Underneath the surface, it’s actually worse. If you exclude Private Education and Healthcare Services, we’ve had negative job growth over the past three months.

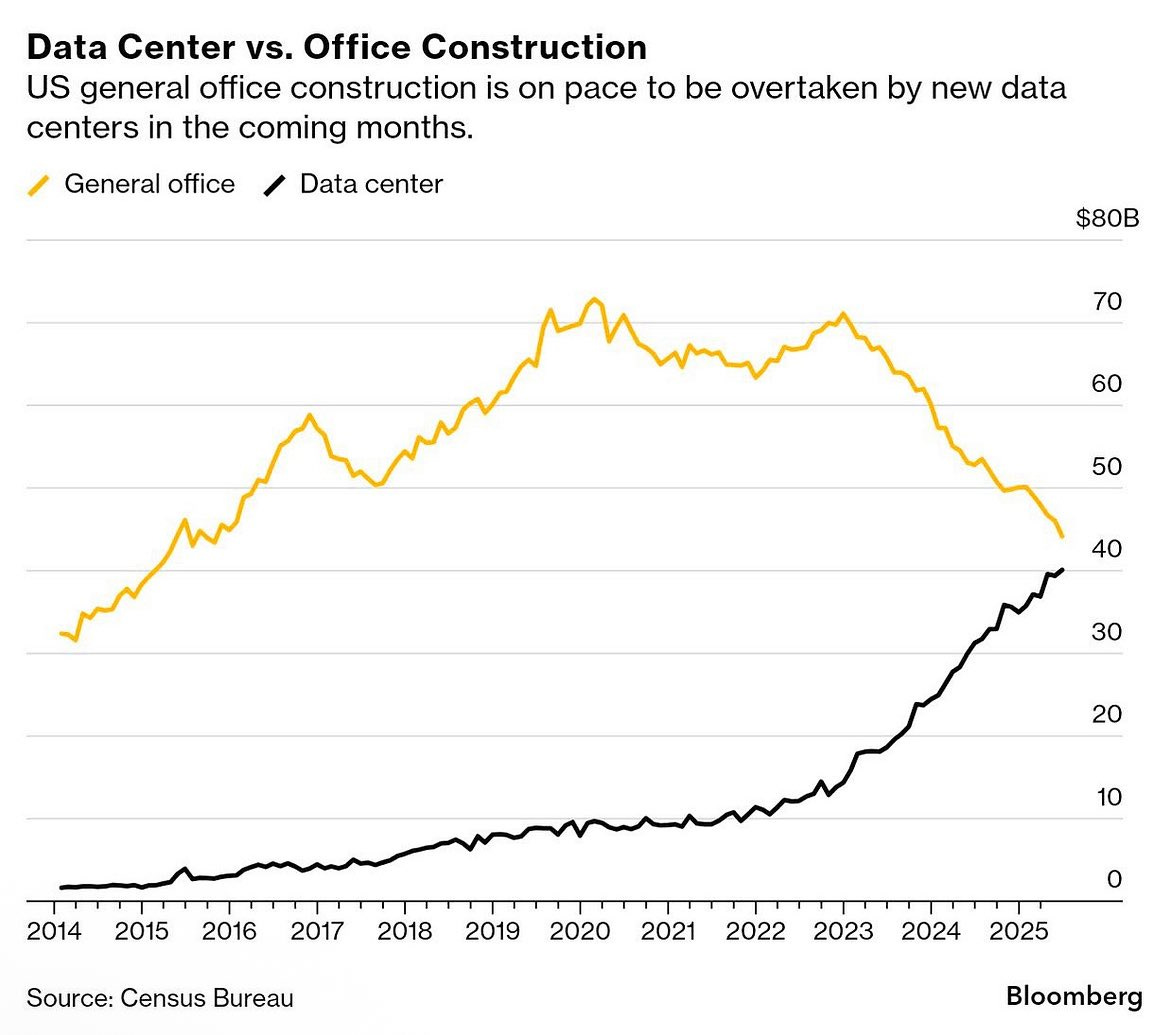

Unfortunately, with the advancement of artificial intelligence, I believe that over the next 10 years, there will be a 20-30% decline in the professional & business services and financial activities job force. Since 2023, capital has rotated from office construction to Data Center construction and Data Center infrastructure buildouts at an eye-opening pace, and we’re a few months away from Data Center spending being greater than Office Construction.

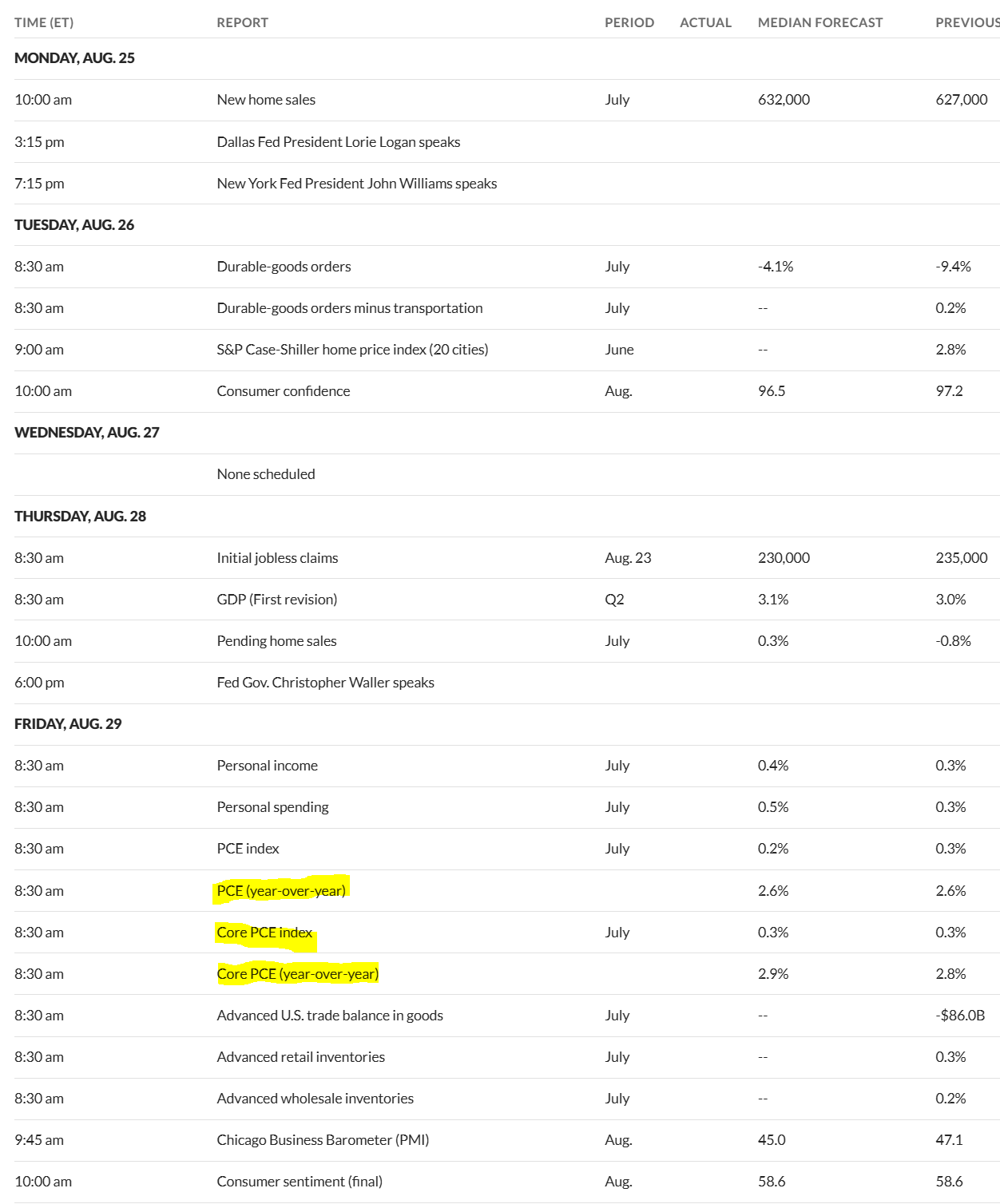

This upcoming week, all eyes will be on PCE.

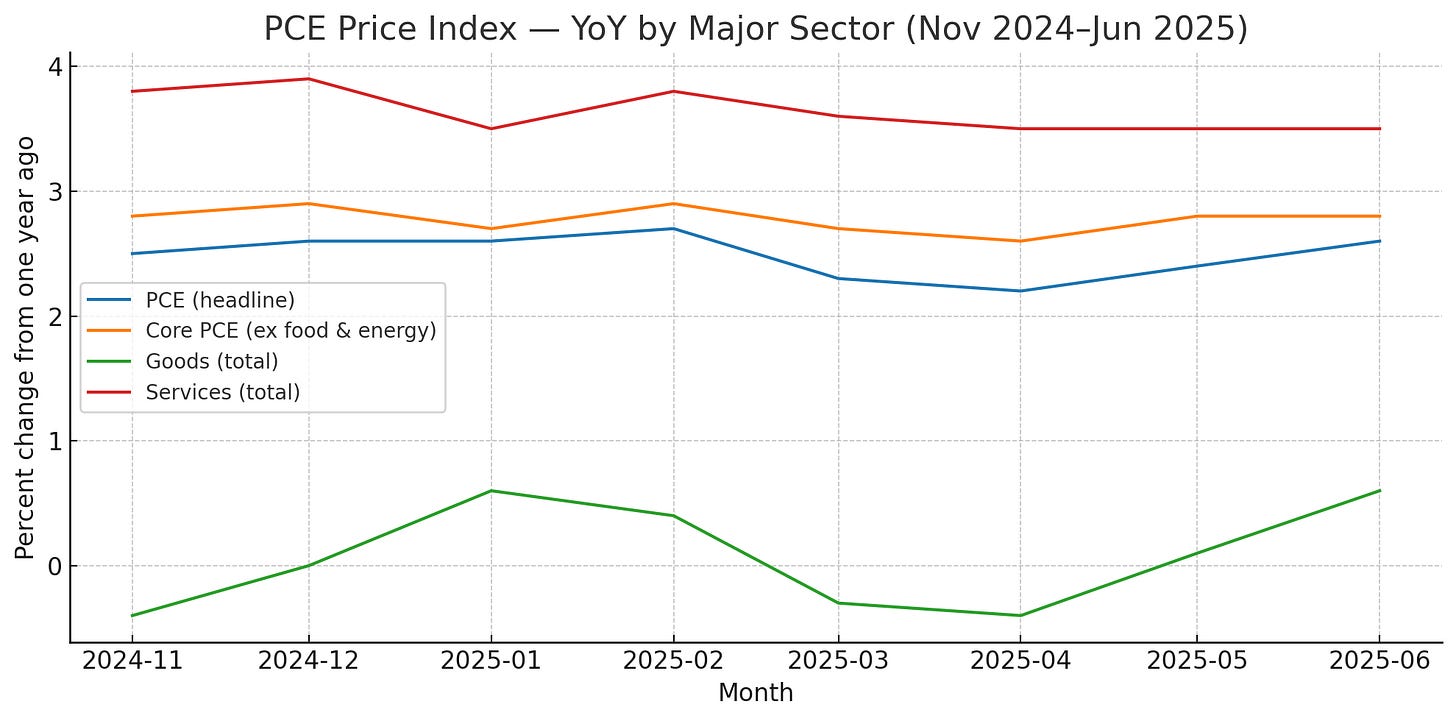

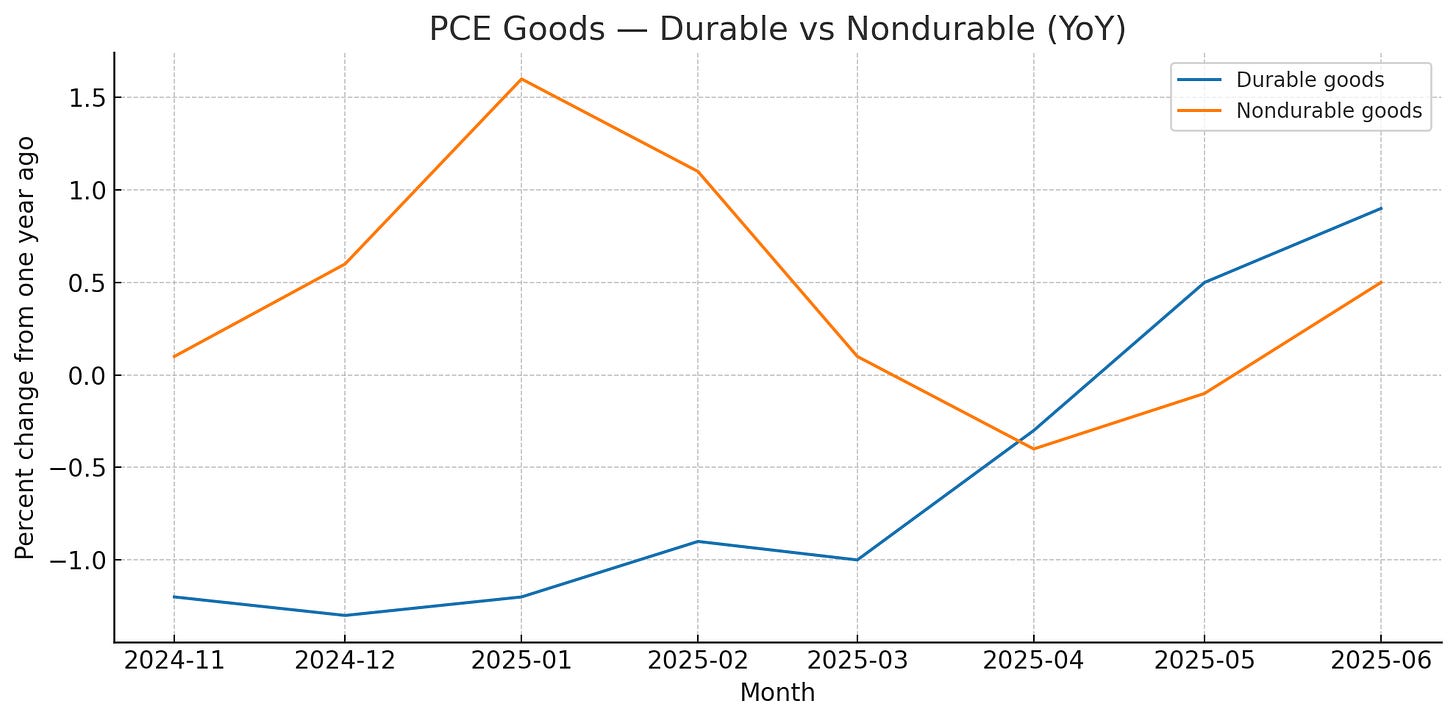

What you’ll need to focus on is the continuous impact of the 10% baseline tariffs on GOODS. Since April, we’ve seen a considerable rise in the durable and non-durable components of PCE, which we believe will continue to rise for the next 3 months and then level out.

In conclusion, we agree that a 25bps cut at the September 17th Fed meeting is the correct move by the Fed, as labor market growth has been negative over the past 3 months if you exclude Healthcare services and Private education. Still, we remain vigilant as we await the next PCE ( August 29th), Nonfarm payrolls (September 5th), and CPI (September 11th) economic releases.