Welcome back to another week. With just fifteen trading days left in 2025, we’re witnessing one of the most exciting setups we’ve seen all year. While everyone’s talking about how “difficult” this year has been, the S&P 500 is casually sitting at +16% YTD. Let that sink in!

The Big Picture: Why This Setup Gets Me Excited

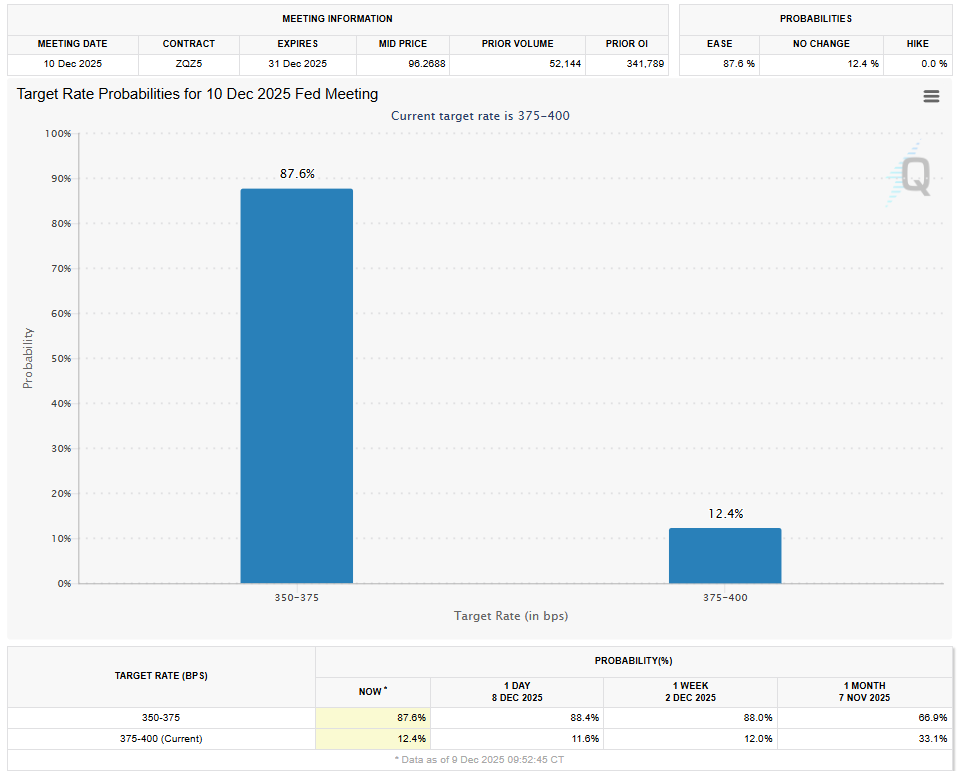

Three weeks ago, sentiment was in the dumps. The S&P violated its 50-day moving average, and we saw classic capitulation behavior. The markets shifted from pricing in +85% of a December rate cut to a sub-50% chance, while the underlying economic picture did not change at all. The job market is weak, and that’s what the Fed cares about. Fast forward to today? Implied volatility has collapsed, positioning has been reloaded, and we’re going into the FOMC with the market pricing an 88% cut.

Today, we’ll cover the setup for tomorrow and into 2026.

What to Expect from Powell: Consensus Says Hawkish Script

Over the past two weeks I’ve been catching up on research and talking with many old colleagues from the buy-side and I’ve been left completely amazed on how everyone’s is on is on 1 side of ship….. all stating that this will be a hawkish cut.

But here’s the silver lining baked into these low expectations: any time Powell emphasizes that “the committee hasn’t had a chance to see the data yet” or mentions being “attentive to labor market risks,” the market can take genuine comfort. When expectations are this anchored to the downside, there’s real opportunity in even modest dovish surprises ESPECIALLY WHEN INSTITUTIONAL POSITIONING IS VERY WELL HEDGED!

Keep reading with a 7-day free trial

Subscribe to SpearPoint Equity Alpha to keep reading this post and get 7 days of free access to the full post archives.