One of the fundamental parts of identifying high-risk-reward trades is conducting a sector analysis to have a holistic view. As we noted in the very first interview (link), generating alpha is achieved by aligning the macro, sector, and individual stock views. This report focuses on the semiconductor subsector which will be a place of incredible trading opportunity in 2024 as dispersion grows between the true AI players.

The Layout of The Ecosystem

Integrated Device Manufacturers

Fabless/Designers

Foundries

Hardware and Equipment

1.) Integrated Device Manufacturer (IDM): These are companies that can do the entire process themselves (Design + Production + Sales). Think of these as your legacy names (Intel & Samsung).

Major Global IDM Companies:

IDM Performance since January 2020

2.) Fabless/Designers: Only design chips and outsource the manufacturing. In column three you’ll find each compani’s product focus

Fabless/Designer Performance since January 2020

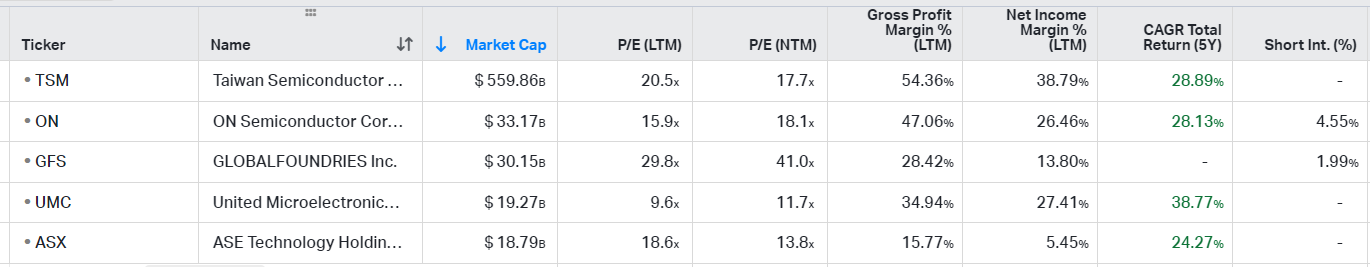

3.) Foundries: They manufacture the semiconductors for the Fabless/Designers above. $TSMC is by far my favorite in the stack

Foundry Performance since January 2020

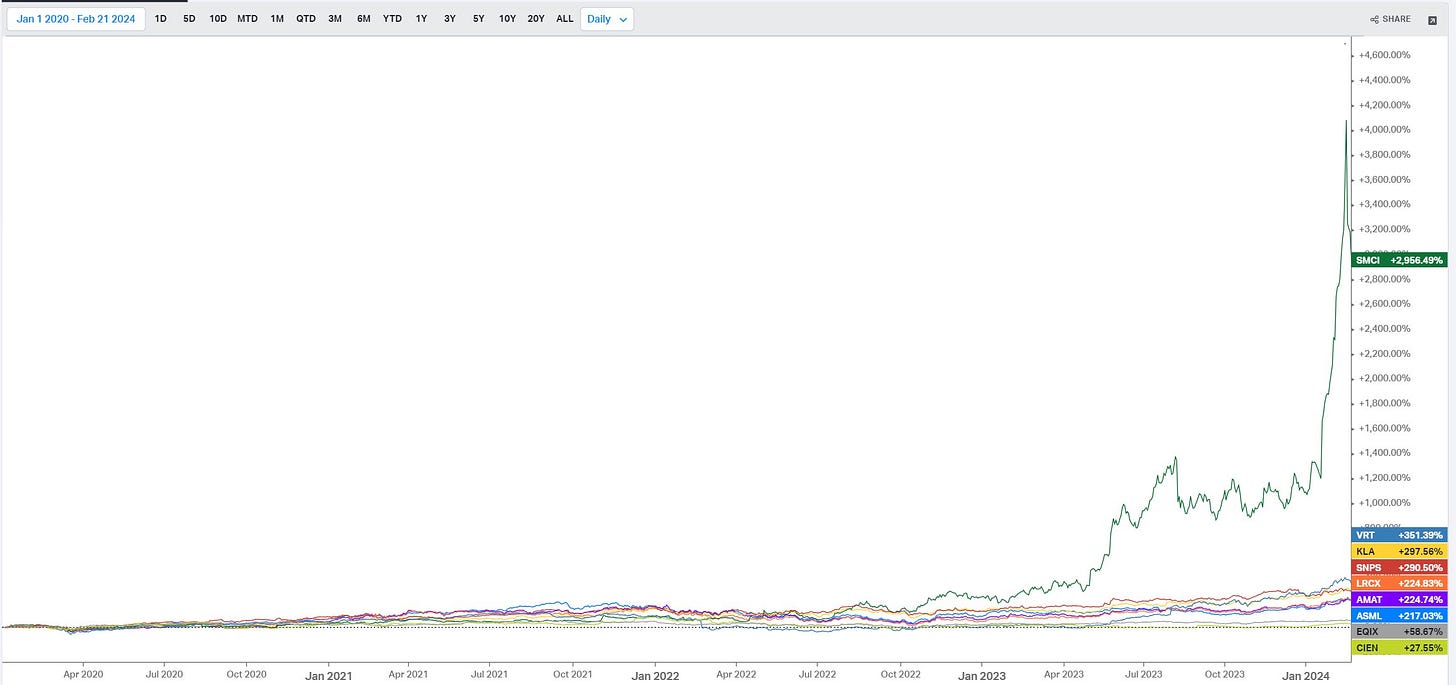

4.) Hardware and Equipment: Provide machinery, thermal/cooling equipment, and network/routing infrastructure. This group is by far my favorite. ASML 0.00%↑ , SNPS 0.00%↑ , EQIX 0.00%↑ ARE MY FAVORITES!

Hardware and Equipment Performance since January 2020

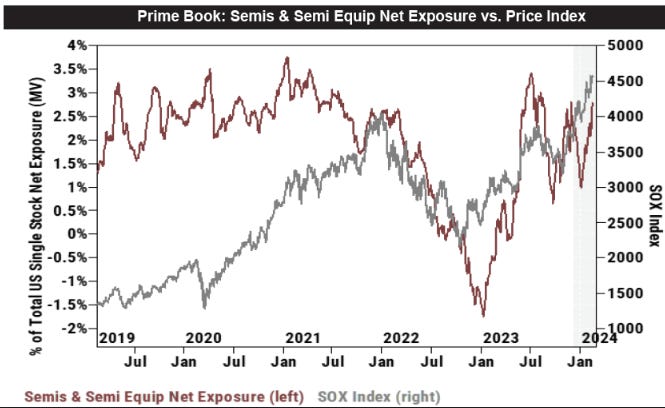

The entire sector is highly CROWDED within the Hedge Fund realm, if you take a look at GS Prime Data their portfolio allocations to the sector are creeping back to 2021 highs!

With that being said It will be all about stock selection over the next 18 months. Outside of NVDA 0.00%↑, which without a doubt is the leading fabless/designer in the AI race, I like the foundry and Hardware & Equipment companies that have the capacity to support the rapidly evolving AI race.

What I Like …….

1.) ASML 0.00%↑ possess monopolistic powers in the sector. It produces advanced Photolithography Machines for foundries (TSM’s of the world). Their Extreme Ultraviolent Lithography machines are the cornerstone of creating high-performance GPUs and the barriers to entry are high due to their technological advancement in photolithography machinery & the extremely high cost of entry (hence why in the 1980-1990s companies moved away from the IDM model to our current segmented ecosystem!!). Fundamentally it’s a powerhouse, Maintaining net income margins in the 20%s throughout economic cycles.

Part 2:

Part two (for paid subscribers) will provide a comprehensive list of the semiconductor stocks that have the highest risk reward and highest probability of outperforming the sector. These will function as the foundation for the alpha trades we run.

As of yesterday, the SpearPoint Equity Alpha publication has gone paid. Subscribers will have access to all of the reports, real-time trades, and podcasts. The alpha sharing won’t stop!